The ongoing geopolitical tensions between Russia and Ukraine have sent ripples through the global financial markets, leading to a surge in cryptocurrency values. Bitcoin, the world's leading digital currency, recently reached a record high of over $94,000 before settling around $92,300. This dramatic increase underscores a growing trend of investors turning to alternative assets amid global uncertainty.

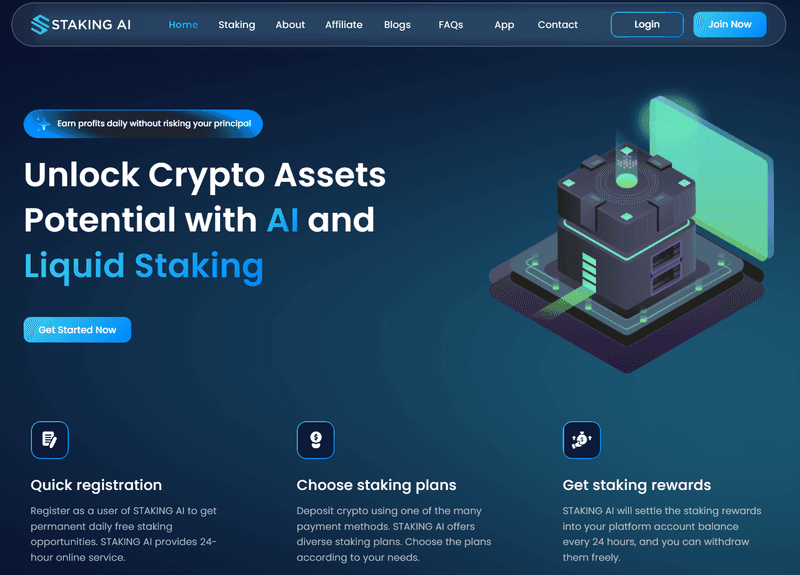

As traditional markets face volatility, the cryptocurrency sector is experiencing unprecedented growth. This shift has brought companies like STAKING AI to the forefront, offering innovative solutions for digital asset holders. STAKING AI has emerged as a significant player in the cryptocurrency staking market, providing a platform for both institutional and retail investors to maximize the potential of their digital holdings.

STAKING AI's focus on Proof-of-Stake (PoS) blockchains offers a comprehensive, non-custodial staking service that prioritizes security, scalability, and user-friendliness. The company's COO, Adam Mitura, emphasized their commitment to providing users with safe and efficient staking tools, regardless of market conditions. This approach has positioned STAKING AI as a reliable option for investors seeking to navigate the complex world of cryptocurrency staking.

The platform's diverse range of staking plans, from free trials to premium options, caters to a wide array of investment sizes and timelines. This flexibility, combined with liquid staking capabilities, allows users to maintain liquidity over their staked assets while potentially earning rewards. Such features are particularly attractive in a market characterized by rapid changes and increasing mainstream adoption.

STAKING AI's growth is indicative of the broader trend in cryptocurrency staking. As Bitcoin and Ethereum continue to dominate headlines, staking has become a preferred method for earning passive rewards. Unlike traditional mining, staking utilizes PoS networks, making it more energy-efficient and accessible to a wider range of investors.

The platform's user-friendly interface allows for quick registration, easy selection of staking plans, and daily reward distributions. This simplicity is crucial in attracting both novice and experienced investors to the cryptocurrency staking space. With over 630,000 stakers and more than $1.7 billion in staked value under management, STAKING AI has established itself as a significant force in the cryptocurrency ecosystem.

The recent rally in Bitcoin prices and the broader adoption of cryptocurrencies, driven by the listing of crypto ETFs and increased institutional interest, suggest that the sector is poised for continued growth. STAKING AI's position as a leading infrastructure provider for PoS blockchains places it at the center of this evolving financial landscape.

As global tensions continue to influence traditional markets, the rise of cryptocurrency staking platforms like STAKING AI represents a significant shift in investment strategies. These platforms offer an alternative that combines the potential for high returns with the benefits of blockchain technology's security and transparency. The growing interest in cryptocurrency staking could have far-reaching implications for the future of finance, potentially reshaping how individuals and institutions approach investment and wealth management.

The success of companies like STAKING AI in this volatile environment highlights the increasing importance of digital assets and blockchain technology in the global financial system. As more investors seek alternatives to traditional markets, the role of cryptocurrency staking platforms is likely to expand, potentially influencing regulatory frameworks and financial policies worldwide.