The recent turbulence in the cryptocurrency market is showing signs of stabilization, according to an analysis by Tide Capital. Significant developments, including the German government's Bitcoin sell-off and substantial inflows into Bitcoin spot ETFs, have set the stage for potential recovery in key digital assets such as Bitcoin (BTC) and Ethereum (ETH).

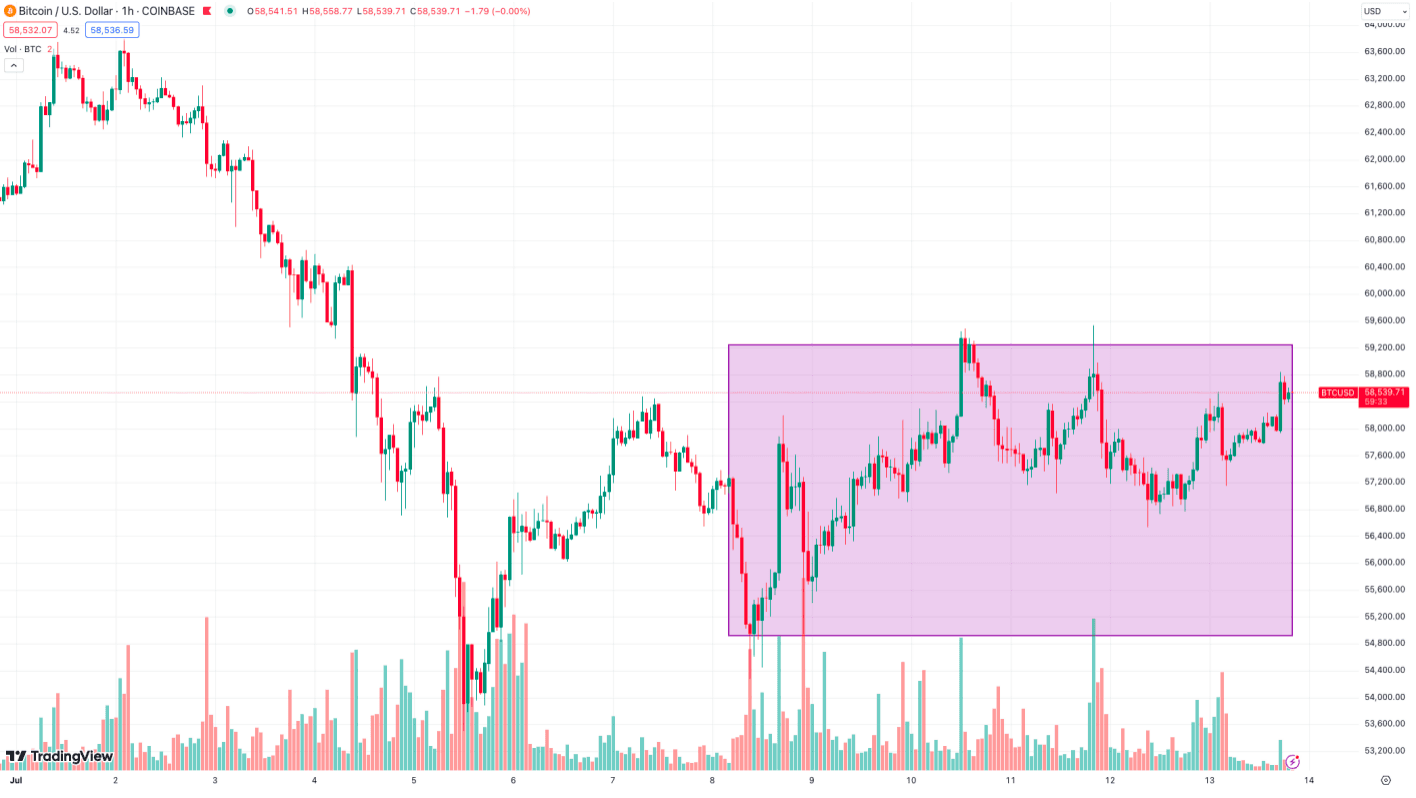

The German government, specifically the Saxony police, began selling nearly 50,000 confiscated Bitcoins in mid-June, triggering over $3 billion in market declines. However, the transfer of all these Bitcoins to exchanges has now mitigated future sell-off impacts. Notably, between July 8th and 12th, the transfer of 40,000 Bitcoins resulted in a temporary dip, followed by a rebound, indicating a strong market demand for BTC and suggesting that the negative effects of the sell-off have largely dissipated.

In parallel, Bitcoin spot ETFs experienced a notable shift. While June saw significant outflows correlating with BTC's downturn, July witnessed net inflows nearing $1 billion. This trend signals optimism among U.S. investors, further bolstered by favorable factors such as potential Federal Reserve rate cuts and upcoming U.S. elections. Consequently, Bitcoin under $60,000 presents attractive investment odds.

The broader market context also supports a positive outlook for Bitcoin. U.S. stocks have consistently risen in 2024, with the Nasdaq hitting historic highs. Although BTC mirrored this trend in the first half of the year, it diverged mid-June due to the German sell-offs, resulting in a nearly 30% drop. However, as the sell-off pressure subsides, BTC is poised to rebound, aligning with the Nasdaq's performance.

Additionally, the approval of ETH spot ETFs is imminent, with market indicators suggesting high probabilities of approval. Despite recent market declines pushing ETH prices back to pre-announcement levels, the anticipated approval is expected to attract significant investments into the crypto market, buoying short-term sentiment and fostering long-term growth.

Altcoins have also undergone deep corrections since June, deflating speculative bubbles and promoting healthier market conditions. TOTAL3, which excludes BTC and ETH, has dropped to $573 billion, down $200 billion from March highs. This correction has squeezed out speculative bubbles, significantly reducing leverage levels and clearing many long positions. Even strong performers like the meme coin $PEPE have lost nearly half their peak value, indicating a broader market correction.

Market concentration is increasing, with Bitcoin's market dominance now exceeding 54%. Compared to BTC and ETH, most altcoins struggle to attract sustained inflows and are unable to outperform the broader market. This trend suggests that holding BTC and ETH may continue to yield better returns.

In conclusion, following the July sell-off, the crypto market appears to be bottoming out. With market adjustments fostering healthier conditions, investors are advised to maintain patience and confidence. Looking forward, holding BTC and ETH may continue to outperform the broader market, setting the stage for potential future bull runs.