In a move that signals a major shift in how mining companies manage their assets, South American Lithium Company (SALCO) has invested $9 million in $GEMS tokens, a digital asset backed by real-world gemstones. This investment, made through Limitless, a global mining conglomerate, and facilitated by the Everest platform, represents a significant step towards the tokenization of real-world assets (RWA) in the mining industry.

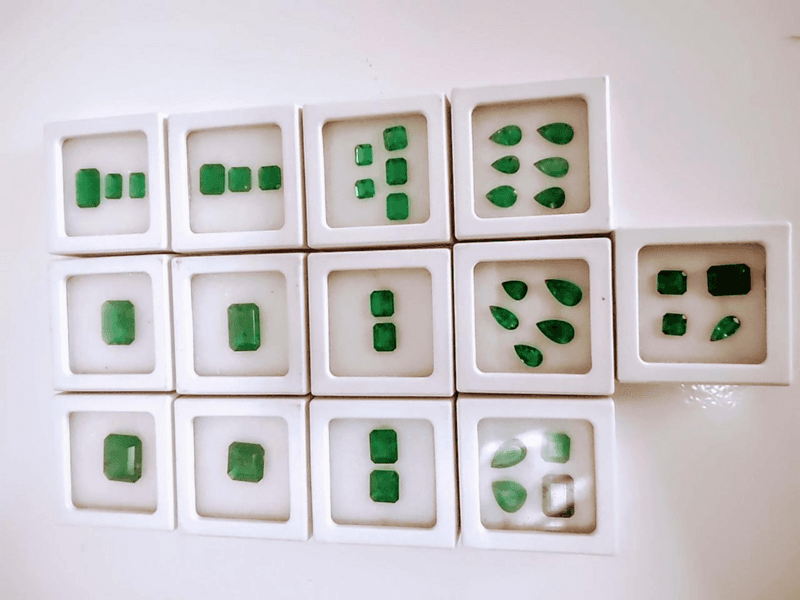

The $GEMS token, launched by Limitless in collaboration with Everest, represents a $20 million offering backed by over $600 million in liquid assets. This makes it the first RWA token of its kind in the tokenization space, potentially setting a new standard for how mining companies can leverage their physical assets in the digital realm.

Juan Lasheras-Bunge of SALCO highlighted the transformative potential of this investment, stating, "The $9M GEMS deal opens our ability to transact with previously illiquid assets, bringing SALCO into the new tokenized future." This sentiment underscores the broader implications of RWA tokenization for the mining industry, where large, illiquid assets have traditionally been challenging to leverage efficiently.

The benefits of tokenizing real-world assets like gemstones extend beyond mere digitization. $GEMS tokens offer enhanced portability, fungibility, and the ability to use these digital representations as collateral. This could potentially unlock new financing options and liquidity for mining companies, allowing them to more effectively utilize their asset base.

For investors and industry observers, SALCO's move signals a growing acceptance of blockchain technology and tokenization in traditional industries. The ability to fractionally own and trade portions of high-value assets like gemstones could democratize investment in the mining sector, potentially attracting a broader range of investors.

The $GEMS token also offers unique features that may appeal to both institutional and individual investors. These include access to a multi-billion dollar mining ecosystem, an industry-leading 4X refund policy, and the ability to stake tokens for up to 20% APY. Such features could set a new benchmark for RWA tokens in terms of investor protections and potential returns.

Matteo Rosetti, General Manager of Limitless, emphasized the significance of SALCO's investment, stating, "SALCO, a leading player in the mining industry, investing $9 million in $GEMS is a strong validation of our vision to unlock value for institutions within the sector." This validation from a major industry player could encourage other mining companies to explore similar tokenization strategies.

The implications of this development extend beyond the mining industry. As more traditional industries adopt blockchain technology and tokenization, it could lead to increased efficiency in asset management, improved liquidity for traditionally illiquid assets, and new investment opportunities for a global audience. The success of the $GEMS token could serve as a case study for other industries looking to tokenize their assets.

However, as with any new financial instrument, there are potential risks and regulatory considerations. The mining industry and financial regulators will likely watch the performance and adoption of $GEMS tokens closely, potentially shaping future policies around RWA tokenization.

As the December 15, 2024 sale deadline for the remaining $GEMS tokens approaches, the industry will be keenly observing the uptake and performance of this novel asset. The success or failure of this initiative could have far-reaching consequences for the future of asset tokenization in the mining sector and beyond.