In a significant development for the cryptocurrency market, OptSwap has officially launched its decentralized options trading platform, potentially revolutionizing how traders engage with crypto derivatives. This new platform aims to address longstanding issues in both traditional finance and centralized cryptocurrency exchanges, offering a fully decentralized, non-custodial, and transparent trading experience.

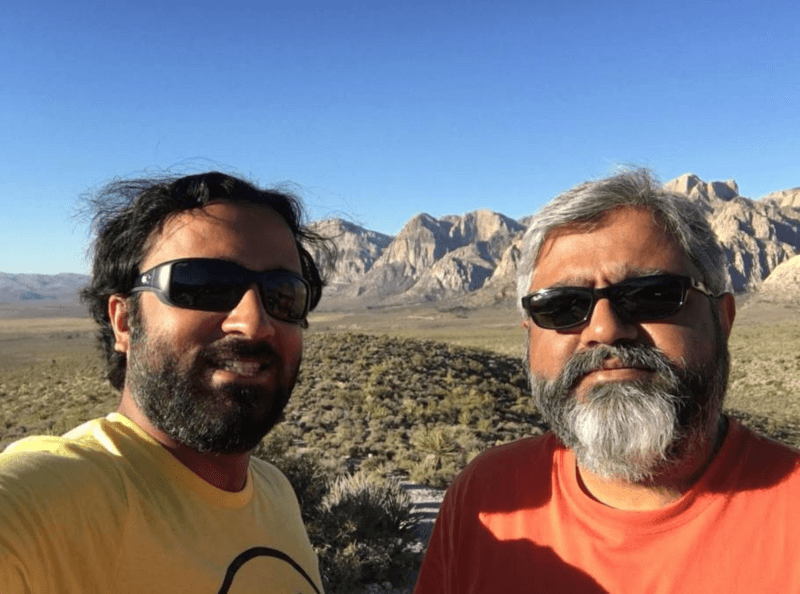

OptSwap, founded by seasoned technologists and crypto enthusiasts Akshay Patel and Dhwanit Patel, positions itself as the "Uniswap of Options." The platform combines a decentralized exchange (DEX) with an automated market maker (AMM) specifically designed for cryptocurrency options. This innovative approach allows users to trade both European and American-style options, as well as multi-legged spread strategies, through an open, fully auditable, on-chain order book and peer-to-peer exchange.

The launch of OptSwap is significant for several reasons. First, it addresses the limitations of centralized exchanges, which have been plagued by issues of transparency and security. By offering a non-custodial trading environment, OptSwap eliminates the risk of exchange hacks or mismanagement of user funds. Second, the platform's decentralized nature opens up global access to crypto options trading, potentially increasing market liquidity and participation.

One of the most notable features of OptSwap is its T+0 settlements, allowing users to instantly exercise the underlying asset or settle in cash after expiration. This stands in stark contrast to traditional finance, where settlement periods can extend to several days. Additionally, the platform's fully collateralized positions eliminate the need for liquidations, addressing a major pain point in cryptocurrency trading.

The implications of OptSwap's launch extend beyond just providing a new trading platform. It represents a shift towards more transparent and accessible financial instruments in the crypto space. By operating under a Decentralized Autonomous Organization (DAO) model, OptSwap empowers its community with ownership and governance rights, aligning with the ethos of decentralization that underpins much of the cryptocurrency movement.

For traders, OptSwap offers a unique value proposition. The platform's integration of a decentralized order book with a specialized AMM for options allows for efficient risk management, a crucial factor in options trading. This could potentially attract both experienced options traders from traditional finance and crypto enthusiasts looking to expand their trading strategies.

The launch of OptSwap also comes at a time when the cryptocurrency market is maturing and seeking more sophisticated financial instruments. As institutional interest in cryptocurrencies continues to grow, platforms like OptSwap could play a crucial role in bridging the gap between traditional finance and the crypto world.

However, the success of OptSwap will depend on several factors. The platform will need to prove its security and reliability over time, especially given the complex nature of options trading. Additionally, it will need to attract sufficient liquidity to ensure efficient pricing and execution of trades.

As OptSwap moves towards its mainnet launch, the team is focusing on expanding its user base through an incentivized testnet. This approach allows the platform to gather valuable user feedback and refine its offerings before a full-scale launch. The company's roadmap includes raising initial funds, conducting technical code audits, and preparing for its mainnet token launch in the coming months.

The launch of OptSwap represents a significant step forward in the evolution of decentralized finance (DeFi) and cryptocurrency trading. By addressing key limitations in both traditional finance and existing crypto platforms, OptSwap has the potential to reshape the landscape of options trading in the digital asset space. As the platform develops and attracts users, it could play a crucial role in expanding the accessibility and sophistication of cryptocurrency derivatives trading.